We are proud to report another win for one of our clients. A homeowner who refused to accept a paper claim from a Wall Street trust that could not prove its rights.

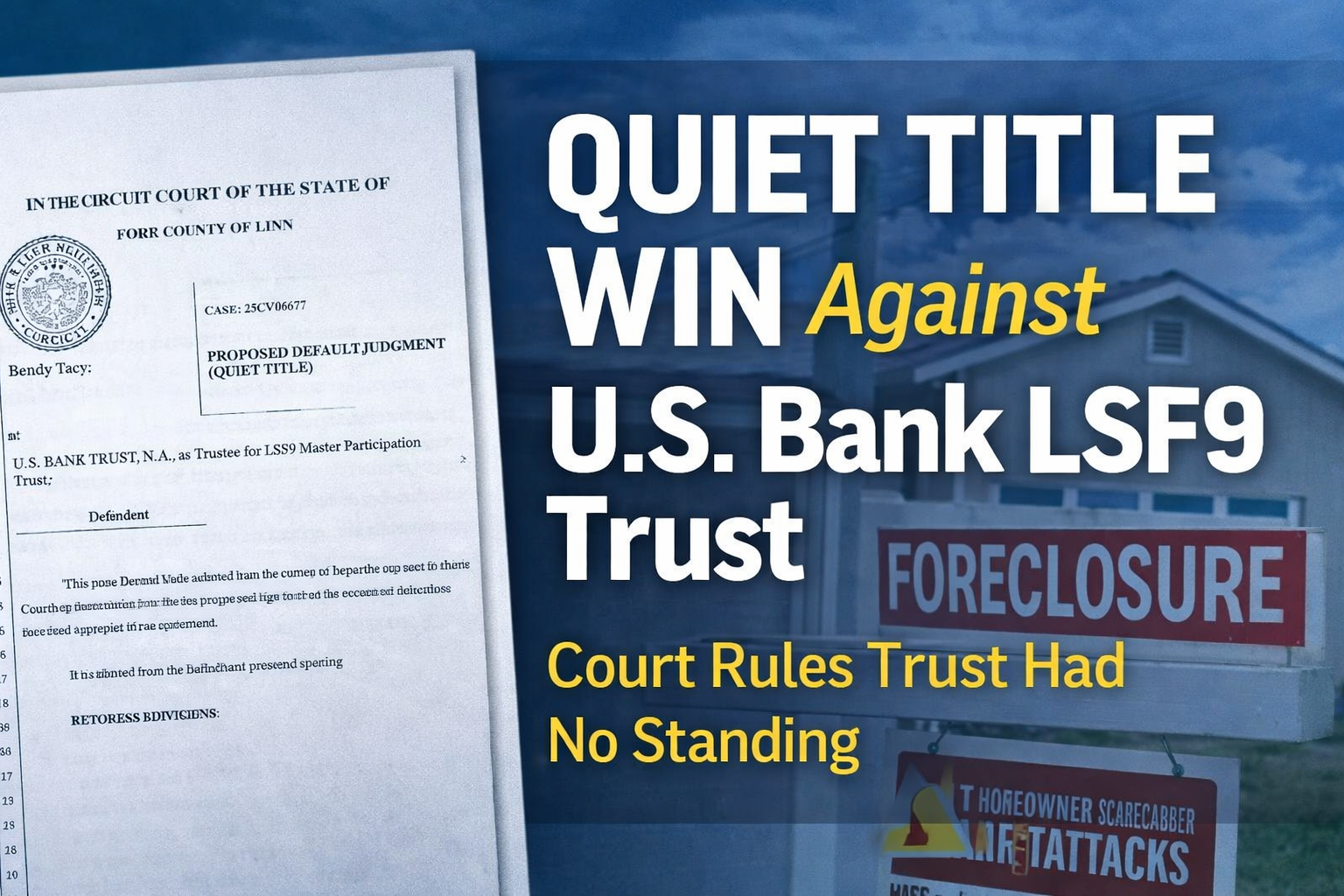

This case was filed in the Circuit Court of the State of Oregon for the County of Linn, Case No. 25CV60677. Our client homeowner brought a quiet title action against U.S. Bank Trust, N.A., as Trustee for LSF9 Master Participation Trust. With our assistance she showed up with evidence and well drafted arguments and she won!

Once again, the trust failed to defend its claim.

What the Court Did

According to the signed Proposed Default Judgment (Quiet Title) entered by the court:

- The court entered default judgment.

- The court ruled that U.S. Bank Trust, as Trustee for LSF9, has no estate, right, title, lien, or interest in the property.

- Title was quieted in favor of the homeowner, free and clear of any claim asserted by the Defendant.

The judgment further states that the defendant and anyone claiming through it are forever barred and enjoined from asserting any adverse interest in the property.

You can view the recorded court judgment by asking to join our private facebook group here

Why This Matters

We have often written about the problems surrounding LSF9 and similar “master participation trusts.” These entities frequently appear in foreclosure cases claiming to act as trustee for a securitized trust. But when pressed to prove:

- The existence of a valid trust

- A lawful transfer of the loan

- Proper authority of the trustee

- An actual unpaid account receivable owed to the trust

They often cannot produce competent evidence.

In this case, we properly challenged in a structured quiet title action, and the defendant simply did not defend the claim. Under Oregon law, when a defendant fails to answer, the allegations of the complaint are deemed admitted.

That is exactly what happened here.

What We Did

We drafted and structured the entire action, including:

- The Quiet Title Complaint

- The Notice of Lis Pendens

- The Motion for Default

- The Proposed Default Judgment

- Supporting affidavits and documentary evidence

This was not an emotional argument. It was not internet theory. It was not wishful thinking. That’s not how we work here at Livinglies/Defend the Foreclosure

This was an evidence-based legal strategy.

The homeowner followed our plan. The court entered judgment. Our client won.

The Key Lesson for Homeowners

Most homeowners lose because they react instead of plan.

They:

- Argue about the note without understanding burden of proof

- Attack assignments without building a coherent theory

- File defensive motions instead of offensive actions

- Fail to force the claimant to prove standing with admissible evidence

Quiet title is not magic. It is a procedural vehicle.

If structured properly, served correctly, and supported with sworn evidence, it shifts the burden to the party making the claim.

If they cannot meet that burden — and many of these trusts cannot — the court must rule based on the record.

That is what happened here.

This Is Not an Isolated Event

We have repeatedly seen claims filed in the name of:

“U.S. Bank Trust, N.A., as Trustee for LSF9 Master Participation Trust”

— without a clear chain of ownership, without proof of acquisition of the alleged debt, and without competent testimony establishing that the trust suffered a financial loss.

Courts do not award property rights based on assumptions. They award property rights based on proof.

When proof is missing, the claim fails.

The Bigger Picture

This judgment does not mean every homeowner automatically wins.

It means this:

When you stop treating foreclosure as a moral issue and start treating it as an evidentiary issue, outcomes change. Ask us how we do this for our clients.

Wall Street designed these structures to avoid scrutiny. But courts still require:

- Jurisdiction

- Proper service

- Admissible evidence

- Proof of standing

- Proof of an actual enforceable obligation

When those elements are challenged properly, many claims collapse.

If You Are Facing a Similar Claim

If your case involves:

- U.S. Bank as Trustee

- LSF9

- A “Master Participation Trust”

- A trust with no clear loan-level proof

Do not assume they are right simply because their name appears on a pleading.

Ask:

- Where is the proof of ownership of the debt?

- Where is the accounting?

- Where is the admissible testimony?

- Who actually suffered a financial loss?

Final Thought

This Linn County judgment confirms what we have said for over 20 years at living lies:

When homeowners use disciplined, evidence-based strategy instead of fear-based reaction, they can win.

Congratulations to our client for standing firm.

Another title cleared. Another claim exposed. Another reminder that paper claims do not equal property rights. We are a national foreclosure defense practice of over 20 years and we just keep winning case. Find out why.

Need help analyzing your foreclosure or title issue?

Visit LivingLies.me and request a case evaluation today, and remember

YOUR HOME IS YOUR CASTLE WE HELP YOU DEFEND IT