Below is another “fake news” report from your friendly St. Louis Federal Reserve. The Foreclosure Crisis isn’t even close to being resolved. Pensions are failing, houses are being foreclosed with fake documents and housing prices have reached unaffordable levels while wages remain flat. This isn’t even close to being the end of the crisis. Until the real issues are resolved America cannot recover.

The Foreclosure Crisis that Caused the 2008 Crash Is Now Ending

The St. Louis Federal Reserve Bank study, “The End Is in Sight for the U.S. Foreclosure Crisis” states:

The Foreclosure Crisis at a National Level

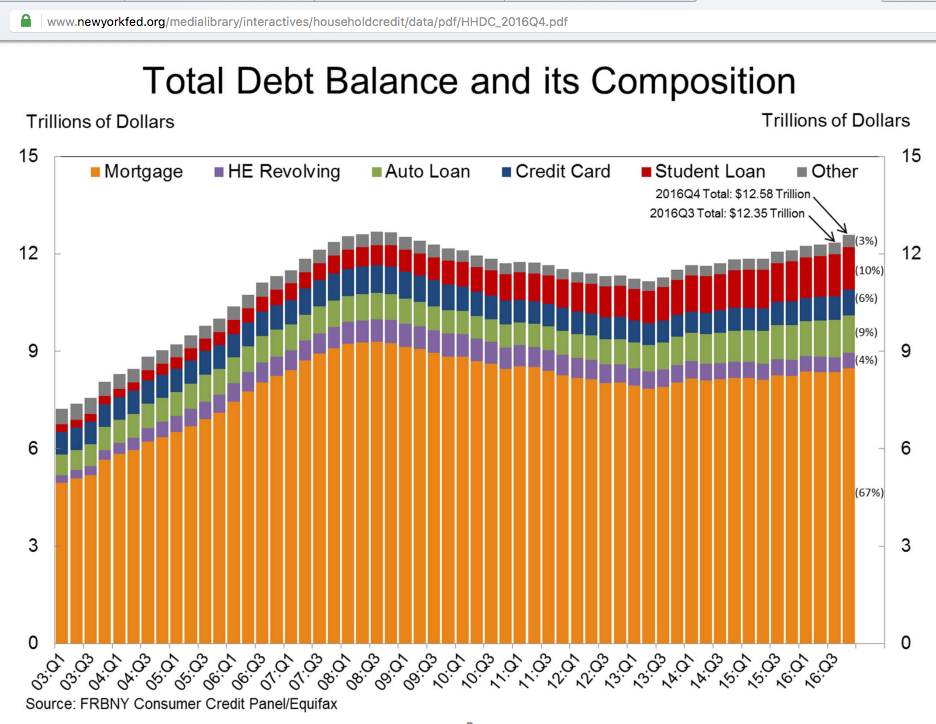

Mortgage Bankers Association data show that the U.S. foreclosure crisis started in the fourth quarter of 2007, when the combined rate reached 2.81 percent, a level that exceeded its five-year moving average by 0.67 percentage points, more than any other previous level. Given that the combined rate stood at 3.2 percent in the third quarter of 2016, this suggests that the nationwide foreclosure crisis has not yet quite ended. However, based on the rate of decline in recent quarters, the data-defined end of the crisis on a national scale is likely to occur as soon as the first quarter of 2017. (See Table 1.) Indeed, comparable data from Lender Processing Services, as shown in the recently released Housing Market Conditions report from the St. Louis Fed, also suggest the foreclosure crisis is nearing its end.

Copyright © Eric Zuesse, Global Research, 2017