http://www.theatlantic.com/magazine/archive/2016/05/my-secret-shame/476415/

Since 2013, the Federal Reserve Board has conducted a survey to “monitor the financial and economic status of American consumers.” Most of the data in the latest survey, frankly, are less than earth-shattering: 49 percent of part-time workers would prefer to work more hours at their current wage; 29 percent of Americans expect to earn a higher income in the coming year; 43 percent of homeowners who have owned their home for at least a year believe its value has increased. But the answer to one question was astonishing. The Fed asked respondents how they would pay for a $400 emergency. The answer: 47 percent of respondents said that either they would cover the expense by borrowing or selling something, or they would not be able to come up with the $400 at all. Four hundred dollars! Who knew?

Well, I knew. I knew because I am in that 47 percent.

I know what it is like to have to juggle creditors to make it through a week. I know what it is like to have to swallow my pride and constantly dun people to pay me so that I can pay others. I know what it is like to have liens slapped on me and to have my bank account levied by creditors. I know what it is like to be down to my last $5—literally—while I wait for a paycheck to arrive, and I know what it is like to subsist for days on a diet of eggs. I know what it is like to dread going to the mailbox, because there will always be new bills to pay but seldom a check with which to pay them. I know what it is like to have to tell my daughter that I didn’t know if I would be able to pay for her wedding; it all depended on whether something good happened. And I know what it is like to have to borrow money from my adult daughters because my wife and I ran out of heating oil.

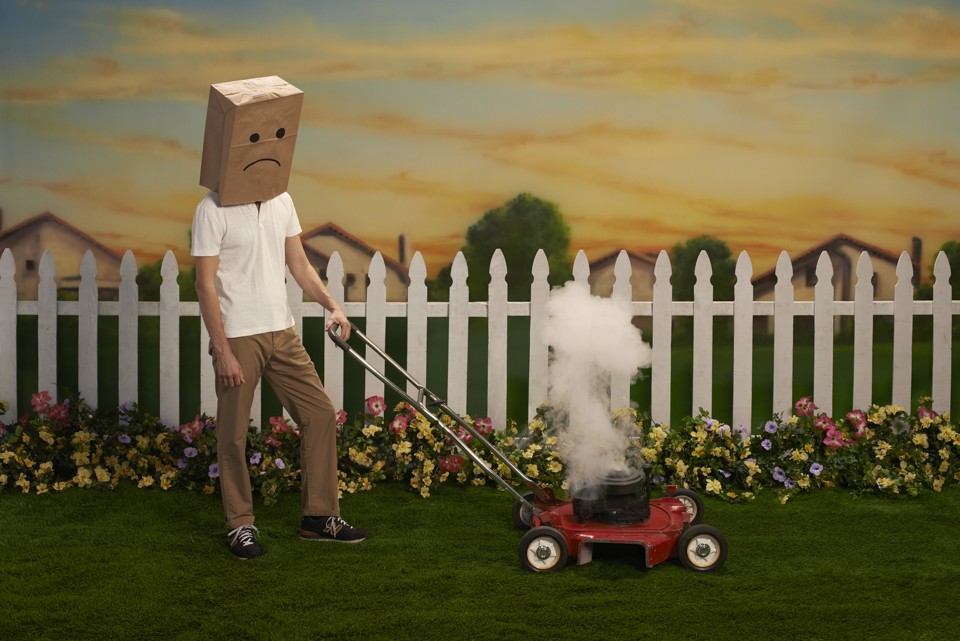

You wouldn’t know any of that to look at me. I like to think I appear reasonably prosperous. Nor would you know it to look at my résumé. I have had a passably good career as a writer—five books, hundreds of articles published, a number of awards and fellowships, and a small (very small) but respectable reputation. You wouldn’t even know it to look at my tax return. I am nowhere near rich, but I have typically made a solid middle- or even, at times, upper-middle-class income, which is about all a writer can expect, even a writer who also teaches and lectures and writes television scripts, as I do. And you certainly wouldn’t know it to talk to me, because the last thing I would ever do—until now—is admit to financial insecurity or, as I think of it, “financial impotence,” because it has many of the characteristics of sexual impotence, not least of which is the desperate need to mask it and pretend everything is going swimmingly. In truth, it may be more embarrassing than sexual impotence. “You are more likely to hear from your buddy that he is on Viagra than that he has credit-card problems,” says Brad Klontz, a financial psychologist who teaches at Creighton University in Omaha, Nebraska, and ministers to individuals with financial issues. “Much more likely.” America is a country, as Donald Trump has reminded us, of winners and losers, alphas and weaklings. To struggle financially is a source of shame, a daily humiliation—even a form of social suicide. Silence is the only protection.

So I never spoke about my financial travails, not even with my closest friends—that is, until I came to the realization that what was happening to me was also happening to millions of other Americans, and not just the poorest among us, who, by definition, struggle to make ends meet. It was, according to that Fed survey and other surveys, happening to middle-class professionals and even to those in the upper class. It was happening to the soon-to-retire as well as the soon-to-begin. It was happening to college grads as well as high-school dropouts. It was happening all across the country, including places where you might least expect to see such problems. I knew that I wouldn’t have $400 in an emergency. What I hadn’t known, couldn’t have conceived, was that so many other Americans wouldn’t have the money available to them, either. My friend and local butcher, Brian, who is one of the only men I know who talks openly about his financial struggles, once told me, “If anyone says he’s sailing through, he’s lying.” That might not be entirely true, but then again, it might not be too far off.

Financial impotence goes by other names: financial fragility, financial insecurity, financial distress. But whatever you call it, the evidence strongly indicates that either a sizable minority or a slim majority of Americans are on thin ice financially. How thin? A 2014 Bankrate survey, echoing the Fed’s data, found that only 38 percent of Americans would cover a $1,000 emergency-room visit or $500 car repair with money they’d saved. Two reports published last year by the Pew Charitable Trusts found, respectively, that 55 percent of households didn’t have enough liquid savings to replace a month’s worth of lost income, and that of the 56 percent of people who said they’d worried about their finances in the previous year, 71 percent were concerned about having enough money to cover everyday expenses. A similar study conducted by Annamaria Lusardi of George Washington University, Peter Tufano of Oxford, and Daniel Schneider, then of Princeton, asked individuals whether they could “come up with” $2,000 within 30 days for an unanticipated expense. They found that slightly more than one-quarter could not, and another 19 percent could do so only if they pawned possessions or took out payday loans. The conclusion: Nearly half of American adults are “financially fragile” and “living very close to the financial edge.” Yet another analysis, this one led by Jacob Hacker of Yale, measured the number of households that had lost a quarter or more of their “available income” in a given year—income minus medical expenses and interest on debt—and found that in each year from 2001 to 2012, at least one in five had suffered such a loss and couldn’t compensate by digging into savings.

You could think of this as a liquidity problem: Maybe people just don’t have enough ready cash in their checking or savings accounts to meet an unexpected expense. In that case, you might reckon you’d find greater stability by looking at net worth—the sum of people’s assets, including their retirement accounts and their home equity. That is precisely what Edward Wolff, an economist at New York University and the author of a forthcoming book on the history of wealth in America, did. Here’s what he found: There isn’t much net worth to draw on. Median net worth has declined steeply in the past generation—down 85.3 percent from 1983 to 2013 for the bottom income quintile, down 63.5 percent for the second-lowest quintile, and down 25.8 percent for the third, or middle, quintile. According to research funded by the Russell Sage Foundation, the inflation-adjusted net worth of the typical household, one at the median point of wealth distribution, was $87,992 in 2003. By 2013, it had declined to $54,500, a 38 percent drop. And though the bursting of the housing bubble in 2008 certainly contributed to the drop, the decline for the lower quintiles began long before the recession—as early as the mid-1980s, Wolff says.

Certain groups—African Americans, Hispanics, lower-income people—have fewer financial resources than others. But just so the point isn’t lost: Financial impotence is an equal-opportunity malady, striking across every demographic divide. The Bankrate survey reported that nearly half of college graduates would not cover that car repair or emergency-room visit through savings, and the study by Lusardi, Tufano, and Schneider found that nearly one-quarter of households making $100,000 to $150,000 a year claim not to be able to raise $2,000 in a month. A documentary drawing on Lusardi’s work featured interviews with people on the street in Washington, D.C., asking whether they could come up with $2,000. Lusardi, who was quick to point out that a small number of passerby interviews should not be mistaken for social science, was nonetheless struck by the disjuncture between the appearance of the interviewees and their answers. “You look at these people and they are young professionals,” Lusardi said. “You expect that people would say, ‘Of course I would come up with it.’ ” But many of them couldn’t.

If you ask economists to explain this state of affairs, they are likely to finger credit-card debt as a main culprit. Long before the Great Recession, many say, Americans got themselves into credit trouble. According to an analysis of Federal Reserve and TransUnion data by the personal-finance site ValuePenguin, credit-card debt stood at about $5,700 per household in 2015. Of course, this figure factors in all the households with a balance of zero. About 38 percent of households carried some debt, according to the analysis, and among those, the average was more than $15,000. In recent years, while the number of people holding credit-card debt has been decreasing, the average debt for those households carrying a balance has been on the rise.

Part of the reason credit began to surge in the ’80s and ’90s is that it was available in a way it had never been available to previous generations. William R. Emmons, an assistant vice president and economist for the Federal Reserve Bank of St. Louis, traces the surge to a 1978 Supreme Court decision, Marquette National Bank of Minneapolis v. First of Omaha Service Corp. The Court ruled that state usury laws, which put limits on credit-card interest, did not apply to nationally chartered banks doing business in those states. That effectively let big national banks issue credit cards everywhere at whatever interest rates they wanted to charge, and it gave the banks a huge incentive to target vulnerable consumers just the way, Emmons believes, vulnerable homeowners were targeted by subprime-mortgage lenders years later. By the mid-’80s, credit debt in America was already soaring. What followed was the so-called Great Moderation, a generation-long period during which recessions were rare and mild, and the risks of carrying all that debt seemed low.

Both developments affected savings. With the rise of credit, in particular, many Americans didn’t feel as much need to save. And put simply, when debt goes up, savings go down. As Bruce McClary, the vice president of communications for the National Foundation for Credit Counseling, says, “During the initial phase of the Great Recession, there was a spike in credit use because people were using credit in place of emergency savings. They were using credit as a life raft.” Not that Americans—or at least those born after World War II—had ever been especially thrifty. The personal savings rate peaked at 13.3 percent in 1971 before falling to 2.6 percent in 2005. As of last year, the figure stood at 5.1 percent, and according to McClary, nearly 30 percent of American adults don’t save any of their income for retirement. When you combine high debt with low savings, what you get is a large swath of the population that can’t afford a financial emergency.

It is ironic that as financial products have become increasingly sophisticated, theoretically giving individuals more options to smooth out the bumps in their lives, something like the opposite seems to have happened, at least for many. Indeed, Annamaria Lusardi and her colleagues found that, in general, the more sophisticated a country’s credit and financial markets, the worse the problem of financial insecurity for its citizens. Why? Lusardi argues that as the financial world has grown more complex, our knowledge of finances has not kept pace. Basically, a good many Americans are “financially illiterate,” and this illiteracy correlates highly with financial distress. A 2011 study she and a colleague conducted measuring knowledge of fundamental financial principles (compound interest, risk diversification, and the effects of inflation) found that 65 percent of Americans ages 25 to 65 were financial illiterates…………………………………………… continued at http://www.theatlantic.com/magazine/archive/2016/05/my-secret-shame/476415/

Reader Stories Notes

- Couldn’t afford mammogram, died

- Avoiding financial woe with sex work

- 25% of paycheck to student loans

- “I can’t afford to drink”

- A suicidal reader bounces back

- Still buying damaged food