COMBO TITLE AND SECURITIZATION SEARCH, REPORT, ANALYSIS ON LUMINAQ

COMBO TITLE AND SECURITIZATION SEARCH, REPORT, ANALYSIS ON LUMINAQ

EDITOR’S QUESTION: Just what do they expect these people to do? The actual number of underwater homes is now approaching 20 million or 40% of all homes — again because of the way they measure it, leaving out things that directly affect the actual price paid and the proceeds of sale. If they think that people are going to sign modifications (i.e., new mortgages waiving all defensive rights against the fraud perpetrated upon them) they better think in terms of reality — who would agree to owe $400,000 on property that is worth $150,000?

I don’t care what you do to the interest rate. The principal MUST be corrected to reflect the reality of the transaction when it first occurred — but that would mean acknowledging appraisal fraud, which would allow people to sue for punitive damages, compensatory damages etc. The only alternative is to use present fair market value which is even lower.

In order for the megabanks to prevail they need your house with you out of it. In order for the economy to recover, you need to stay in your house, recover any home taken from you so far, and recover at least part of the meager wealth you had before this giant fraud began. No modification plan publicly discussed allows for that to happen. They say that is the goal but it isn’t — not without principal correction to true market value when the loan transaction occurred.

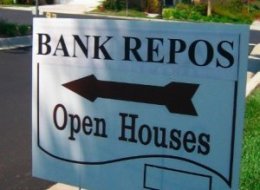

Number Of Underwater Mortgages Rises As More Homeowners Fall Behind

DEREK KRAVITZ 03/ 8/11 01:40 PM ![]()

WASHINGTON — The number of Americans who owe more on their mortgages than their homes are worth rose at the end of last year, preventing many people from selling their homes in an already weak housing market.

About 11.1 million households, or 23.1 percent of all mortgaged homes, were underwater in the October-December quarter, according to report released Tuesday by housing data firm CoreLogic. That’s up from 22.5 percent, or 10.8 million households, in the July-September quarter.

The number of underwater mortgages had fallen in the previous three quarters. But that was mostly because more homes had fallen into foreclosure.

Underwater mortgages typically rise when home prices fall. Home prices in December hit their lowest point since the housing bust in 11 of 20 major U.S. metro areas. In a healthy housing market, about 5 percent of homeowners are underwater.

Roughly two-thirds of homeowners in Nevada with a mortgage had negative home equity, the worst in the country. Arizona, Florida, Michigan and California were next, with up to 50 percent of homeowners with mortgages in those states underwater.

Oklahoma had the smallest percentage of underwater homeowners in the October-December quarter, at 5.8 percent. Only nine states recorded percentages less than 10 percent.

In addition to the more than 11 million households that are underwater, another 2.4 million homeowners are nearing that point.

When a mortgage is underwater, the homeowner often can’t qualify for mortgage refinancing and has little recourse but to continue making payments in hopes the property eventually regains its value.

The slide in home prices began stabilizing last year. But prices are expected to continue falling in many markets due to still-high levels of foreclosure and unemployment.