MOST POPULAR ARTICLES

DISCOUNT FOR EARLY BIRD REGISTRATION RUNS OUT ON JUNE 22

CLICK HERE TO REGISTER FOR 2 DAY GARFIELD CONTINUUM CLE SEMINAR

GET COMBO TITLE AND SECURITIZATION ANALYSIS – CLICK HERE

GET COMBO TITLE AND SECURITIZATION ANALYSIS – CLICK HERE

LIVINGLIES VALIDATED IN 4TH STATE IN AS MANY DAYS

EDITOR’S NOTE: In plain language the “securitization” of loans at least with respect to residential mortgage loans is a myth, an illusion, A LIE. It is one of many lies about these mortgages and we are living it as though it was real, which is why this blog is entitled LIVINGLIES. If the loans never made it to the trust, there was no transfer and thus there was no securitization, which means that the investors bought empty mortgage bonds with no value and no prospects for value.

This fact does NOT invalidate the obligation, however. But the fact that securitization was faked doesn’t validate the obligation either. Nor does it create a valid perfected lien against a home. That is a lie too, but for different reasons. In most instances there is no money due to anyone (except to the investors from the investment bankers) because the obligation that would been created was contemporaneously transferred to third parties who paid it. The fact that it was paid to the agents of the investors rather than the trusts or the investors themselves does not remove the fact that the obligation is paid in full and therefore not due, much less capable of being in default.

Where the article misses a key point is in its knee-jerk reaction to the accusation of free house to the borrower. If that is the collateral benefit arising out of Wall Street misconduct, so be it.

The real issue here is not whether there is going to be a free house awarded, but to whom it will be awarded. There is no reason that interlopers (pretenders) should be allowed to get the collateral benefit of a free house, having defrauded all the real parties in interest. It stands to reason that the victims of the fraud should get the collateral benefit. If that means they get a little more than they are entitled to spending upon how you look at it, this seems far more preferable than proceeding in the business as usual manner of only letting collateral benefits flow toward big business and big banks. Every once in a while, if the banks screw up enough and step on enough rakes, the little guy should get the benefits if that is the way the cards fall.

The article below from Naked Capitalism attributes the original idea that securitization was always a myth to others. It happened here first and for a long time was ignored. Now everyone is adopting it as their own idea. That is good news for homeowners. Yet it is only fair that after nearly 4 years of work to get the message out, that credit be given here that the new decisions in the last week are the result of, and in some instances quotes from the expert declarations written and signed by me.

Michigan Court Relies on New York Trust Theory, Rules Loan Never Made it to Trust

A June 6 trial court decision in Michigan, Hendricks v. US Bank, has not gotten the attention it warrants because to the extent it has been noticed, it has been depicted as invalidating an effort to effect a note (the borrower IOU) transfer via MERS. While that was one of the grounds for a ruling favorable to the borrower, the court also considered and gave a thumbs’ up to what we call the New York trust theory. That has far more significance, as readers will see shortly (hat tip to Foreclosure Fraud for this sighting).

This legal argument, which so far has been tested in a very few cases (primarily in Alabama, since it was perfected by Alabama attorney Nick Wooten) was the basis of a favorable ruling in Alabama trial court. The reason it bears watching is that if the New York trust theory continues to be validated in court, it has devastating consequences for most post 2004 vintage residential mortgage backed securities. it has been the subject of a long-running argument among legal experts, with the Congressional Oversight Panel, Adam Levitin, as well as consumer lawyers like respected bankruptcy attorney Max Gardner on one side, and securitization industry incumbents like the American Securitization Forum and SNR Denton.

The bare bones outline of the argument is that the trusts, the legal vehicle that holds the mortgage loan, in virtually all securitizations, elected New York law as the governing law for the trust. New York law is well established and very rigid. A trust can act ONLY as stipulated; any deviation is a “void act” and has no legal force.

But the problem is that the notes appeared not to have gotten to the trust. As we wrote earlier:

…. there is substantial evidence that in many cases, the notes were not conveyed to the trust as stipulated. As we have discussed, the pooling and servicing agreement, which governs who does what when in a mortgage securitization, requires the note (the borrower IOU) to be endorsed (just like a check, signed by one party over to the next), showing the full chain of title. The minimum conveyance chain in recent vintage transactions is A (originator) => B (sponsor) => C (depositor) => D (trust).

The proper conveyance of the note is crucial, since the mortgage, which is the lien, is a mere accessory to the note and can be enforced only by the proper note holder (the legalese is “real party of interest”). The investors in the mortgage securitization relied upon certifications by the trustee for the trust at and post closing that the trust did indeed have the assets that the investors were told it possessed.

The pooling and servicing agreement also provided that the transfers had to take place by a particular cutoff date, which was typically no later than 90 days after the closing of the deal. That means notes cannot be transferred in at a later date.

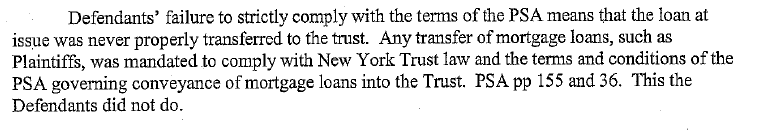

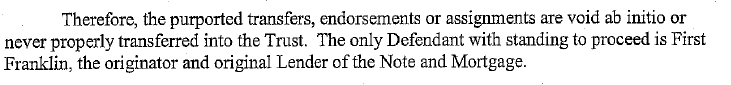

The ruling is very clear that the note never made it to the trust:

Note that the judge rules that someone can foreclose, but it’s not the trust, it’s the original lender. But that is unacceptable to the mortgage industrial complex. They cannot afford to admit they defrauded investors, which is what a foreclosure in the name of the original lender amounts to.

So when people complain about borrowers getting free houses, they act as if it’s the borrower’s fault. That’s the wrong place to assign blame. No one is saying the borrower does not owe somebody money. And the borrowers aren’t seeking a free house; they usually came to this juncture because they thought their records had overcharges in them or they thought they were a good candidate for a mod but could not get the servicer to consider their case. It’s the originators and packagers who put themselves in the situation of not being able to enforce the debt, not the borrower.

The apparent widespread abandonment of the practice of crossing the ts and dotting the is potentially devastating. If the failure to convey notes properly is as widespread as we have been told by various observers (and Abigail Field’s sample confirms), the mortgage industry has a monstrous problem on its hands. As the Michigan ruling suggests, at a minimum, notes not transferred properly are actually owned by someone earlier in the securitization chain. But no one wants to admit that; it means the investors were lied to and hold paper that does not have clear legal rights to foreclose and that originatorrs, servicers and trustees have committed massive securities fraud. And in a worse case scenario, if no notes were transferred to the trust by closing, there is a contract formation failure.

This is the sword of Damocles hanging over the bond markets. The incumbents, bizarrely, seem intent on pretending it does not exist rather than trying to do something to alleviate the damage.

I’m including the full ruling below since it’s short and readable and I know some readers enjoy court filings.

Hendricks v. US Bank, June 6, 2011